Explosive Moves in Copper

Volatile Price Action

Copper prices are on watch ahead of the weekend following a heavy reversal lower from the all-time highs printed yesterday. The futures market hit highs of 6.5850 before sharply reversing 10% lower. The move has been linked to profit taking as price tested the 6.5000 level as well as a rebound in USD. Volatility in copper prices recently suggests the return of speculative buyers after the washout in mid-January as China launched a crackdown on HFT. Prices quickly recoiled as China sought to dampen speculative trading activity there. However, with a spike across China’s exchanged seen yesterday into that push higher, it’s likely that these traders have returned, quickly booking profits on the move, leading to the sharp reversal.

Fed Chair News Due

Traders will be keeping an eye on USD today with the Dollar currently rallying head of anticipated news that Trump will announce the new Fed chair pick. Kevin Warsh is expected to be announced today, with USD rallying given his reputation as a hawk. If USD continues to push higher, this could see copper prices retreating deeper near-term. Global risk flows are also on watch following news of fresh Trump tariffs against countries supplying oil to Cuba and threats of further tariffs on Canada. If Trump does pursue a fresh tariff agenda this will weigh sharply on global copper demand expectations, leading pries lower near-term.

Technical Views

Copper

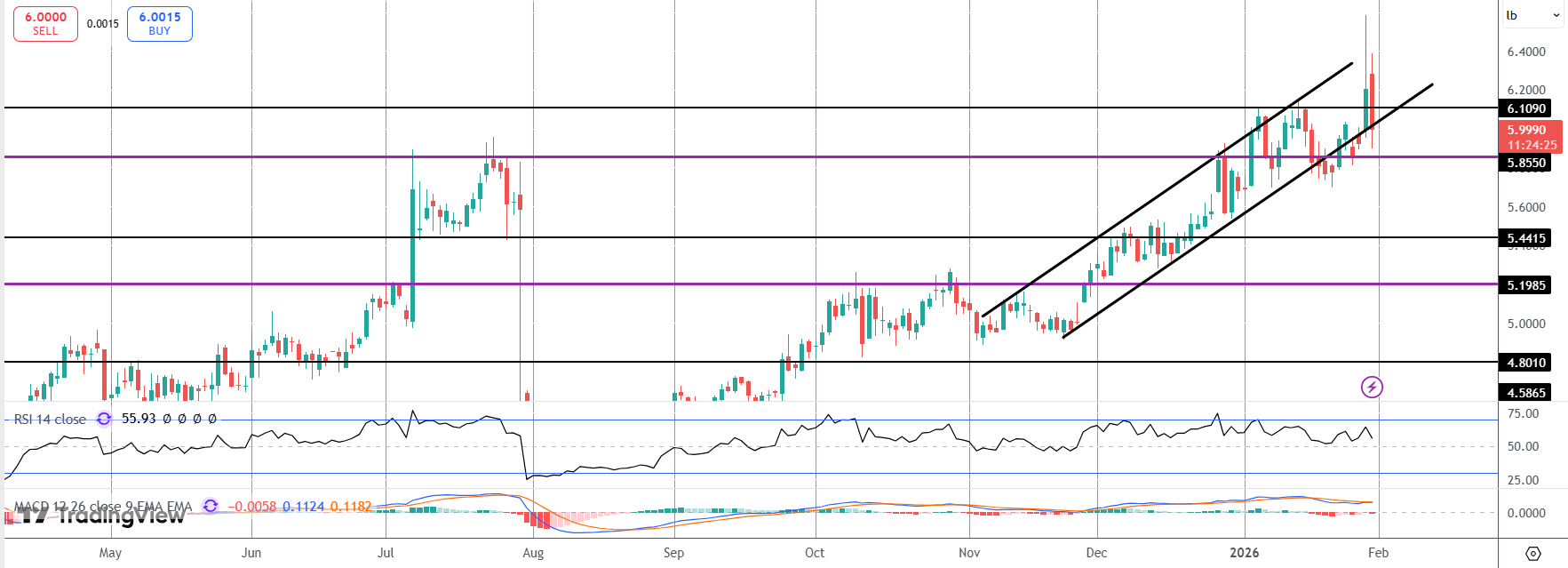

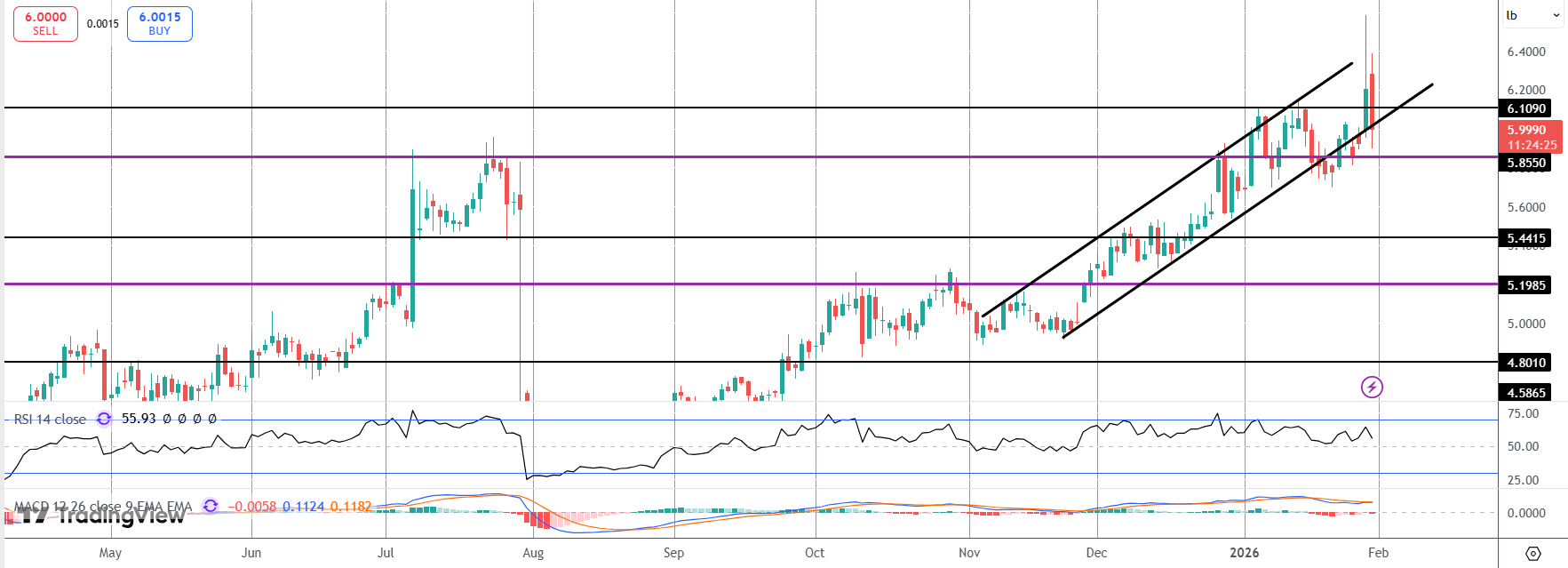

The reversal in copper has seen the market trading back below the 6.1090 level with price currently bouncing off the bull channel lows. While price holds above the 5.8550 level, focus is on a continuation higher. Below there, a test of deeper support at 5.4415 can be seen next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.